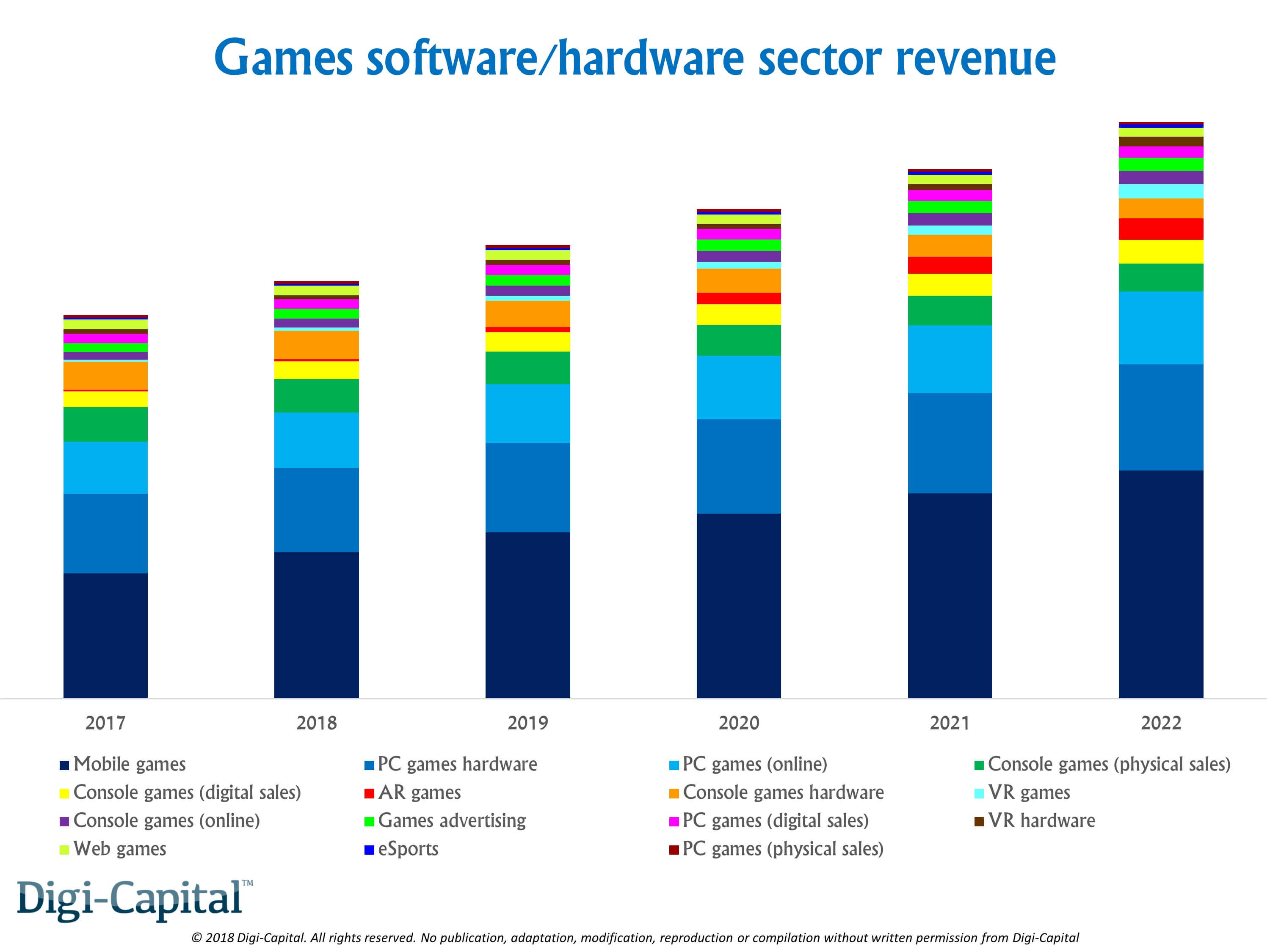

Digi-Capital has issued its new Games Q1 2018 report, detailing how the three big sectors of mobile games software, PC games hardware, and PC games (online) could take just under three-quarters of total games market revenue by 2022. According to the report, if mobile games software continues its outperformance of recent years, it could deliver in the $55 billion to $60 billion range this year, and grow to $90 billion to $95 billion by 2022.

PC games hardware sales could hit $30 billion to $35 billion in 2018, growing steadily to between $40 billion and $45 billion in the same timeframe. Lastly PC games (online) could drive $20 billion to $25 billion this year, also growing steadily to $25 billion to $30 billion by 2022.

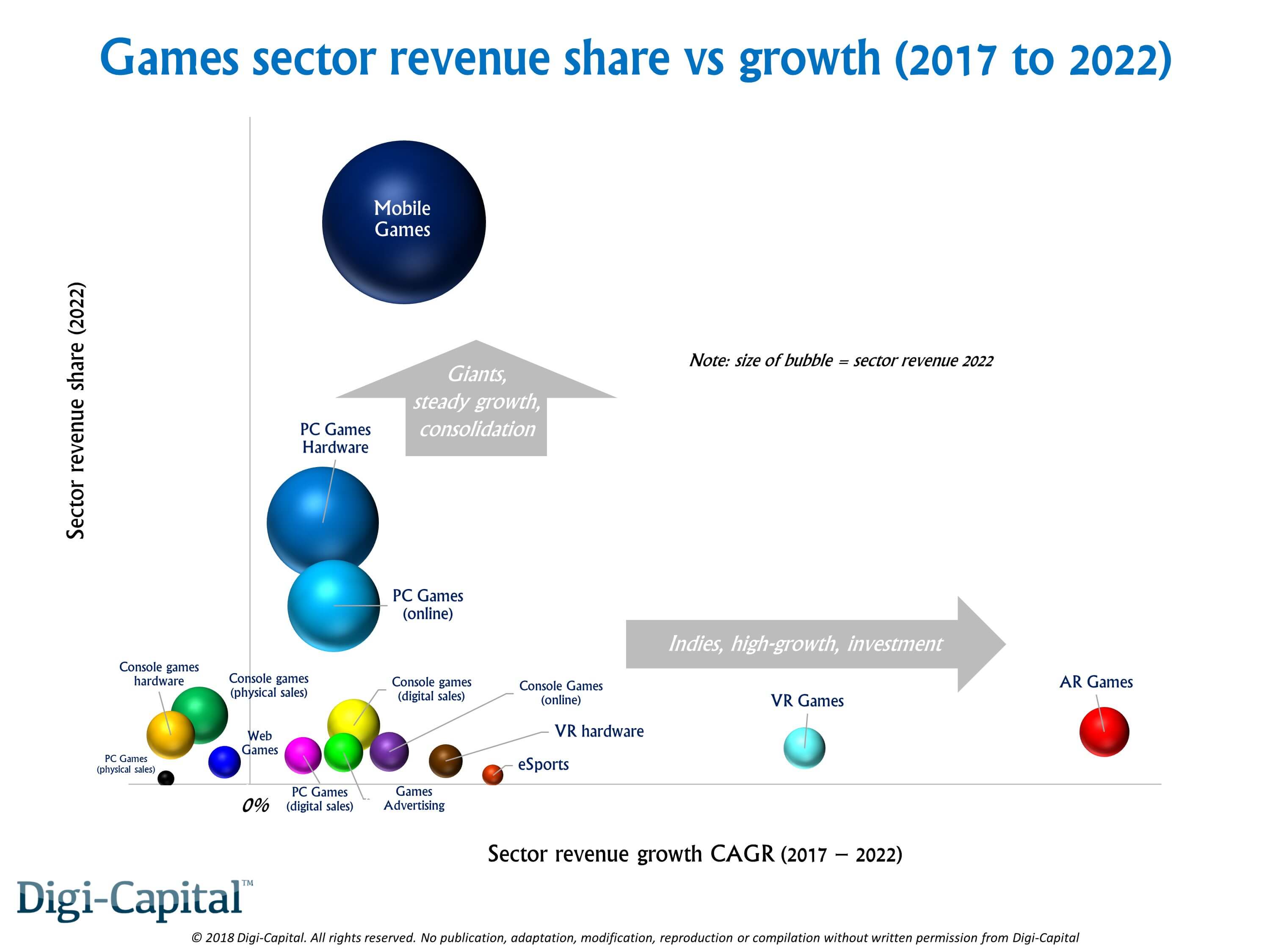

Console games (physical sales) could still produce significant revenue by 2022, despite long-term decline. All the other sectors might be in the high to low single digit billions in 5 years, including steady growth console games (digital sales), high growth AR games (from a low base), long-term ex-growth console games hardware (even with Nintendo Switch’s recent outperformance), high growth VR games (from a low base), solid growth console games (online), steady growth games advertising, low growth PC games (digital sales), steady growth VR hardware (from a low base), declining web games, strong growth (but small) eSports and declining PC games (physical sales).

At a platform level, mobile games (software only) could approach two-fifths, and PC games (software/hardware) one-third of all games revenue by 2022. Console games (software/hardware) could see less than one-sixth of all market revenue in 5 years. VR games (software/hardware) and AR games (software only) are both going to be big, but they’re not the same scale as the three major platforms. Web games are not growing, and exciting eSports might still produce less than 1% of total industry revenue long-term (but do wonders as a marketing tool for games on the major platforms).

All in all, this research explains why more and more companies are trying their best to expand their in-game monetization systems. As the graphs suggest, there is a HUGE crowd on the PC that buys DLCs, subscribes to services or games and purchases in-game stuff (microtransactions). So from a business perspective, it makes sense to throw as many microtransactions to a game as possible. It’s not a consumer-friendly tactic but from the looks of it, things are not going to improve in the near future.

John is the founder and Editor in Chief at DSOGaming. He is a PC gaming fan and highly supports the modding and indie communities. Before creating DSOGaming, John worked on numerous gaming websites. While he is a die-hard PC gamer, his gaming roots can be found on consoles. John loved – and still does – the 16-bit consoles, and considers SNES to be one of the best consoles. Still, the PC platform won him over consoles. That was mainly due to 3DFX and its iconic dedicated 3D accelerator graphics card, Voodoo 2. John has also written a higher degree thesis on the “The Evolution of PC graphics cards.”

Contact: Email