According to one recent report by DigiTimes, the semiconductor industry spending is booming, due to increasing demand from the market, and other contributing factors. The recent COVID-19 pandemic has also sparked a surge in semiconductor fab spending.

Due to increasing popularity of 5G devices, artificial intelligence, high-performance computing and edge computing, the demand for advanced chips has been increasing at a much faster rate in recent years.

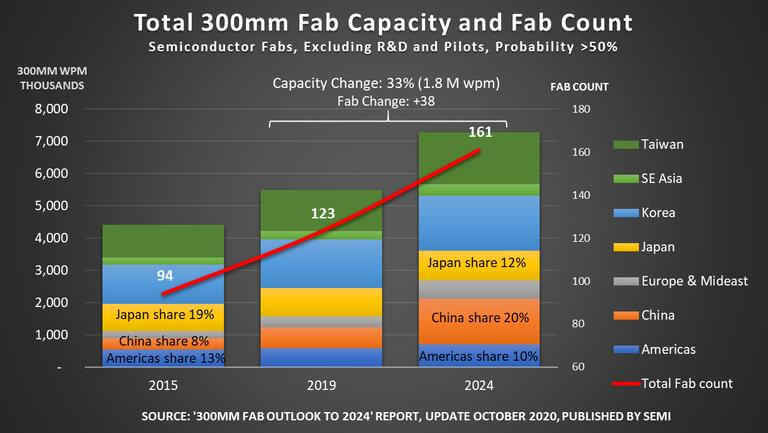

SEMI which is a global industry association representing the electronics manufacturing/chip design and design supply chain, has predicted that at least 38 new 300mm fabs will come online by 2024, thus significantly increasing the available capacity in the semiconductor business.

In its “300mm Fab Outlook to 2024” report published recently, SEMI said the Covid-19 pandemic has sparked a surge in fab spending this year, and the increase is expected to stretch into 2021.

It said powering the growth is the rising demand for cloud services, servers, laptops, PC/console Gaming and healthcare technology. SEMI said besides fast-evolving technologies such as 5G, the Internet of things (IoT), automotive, artificial intelligence (AI) and machine learning that continue to fuel demand for greater connectivity, large data centers and big data are also behind the increase.

SEMI president and chief executive officer (CEO) Ajit Manocha said the Covid-19 pandemic is accelerating a digital transformation sweeping across nearly every industry imaginable to reshape the way we work and live.

“The projected record spending and 38 new fabs reinforce the role of semiconductors as the bedrock of leading-edge technologies that are driving this transformation and promise to help solve some of the world’s greatest challenges,” Ajit Manocha said in a statement accompanying SEMI’s announcement of its report.

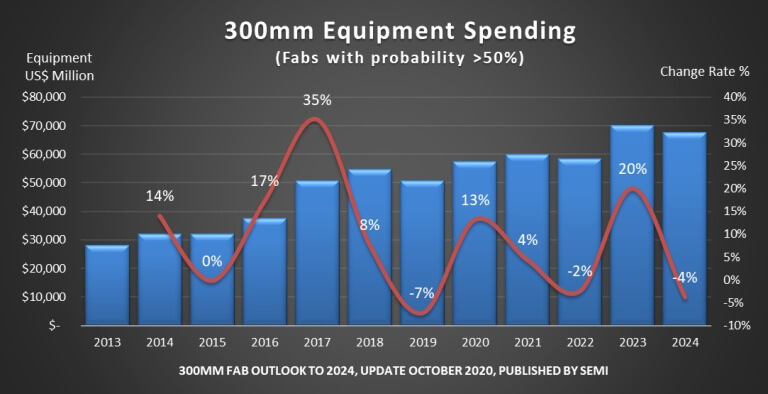

After a surge in 2020, semiconductor fab investments are expected to continue to increase in 2021, but at a reduced rate of 4% year-over-year. SEMI then predicts a 2% slowdown in 2022, followed by a 20%, or $70 billion, record high rise in 2023. The year 2024 will, however, experience a 4% downturn, SEMI said.

SEMI has made the conservative projection that at least 38 new 300mm fabs will open from 2020 to 2024. Asia will be well represented since Taiwan and China are set to add eleven and eight 300mm volume fabs, respectively. The chip industry will then command 161 ‘300mm volume fabs’ by 2024, SEMI said. Over the same time interval, SEMI said it expects per-month fab capacity to increase by about 1.8 million wafers to reach over 7 million.

SEMI predicts that over $250 billion will be spent on 300mm fab equipment from 2019-2024, with equipment budgets hitting an all-time-record of $70 billion in 2023.

As mentioned before and to reiterate, after the new and upgraded fabs come online by the end of 2024, the global 300mm fab capacity will reach over 7 million wafer starts per month (WSPM). In total, 161 300mm fabs will be operational by the end of 2024, up from 123 in 2019. Of these new fabs, 11 volume fabs are expected in Taiwan and eight will be in China.

TSMC is also building a new 300mm fab in Arizona, the first 300mm fab from the semiconductor foundry giant in the country.

Between 2020 and 2024, SEMI expects Europe/Mideast will increase 300mm fab spendings by 164%, Southeast Asia by 59%, Americas by 35%, and Japan by 20%.

In the meantime, China is set to increase its global share of 300mm capacity from 8% in 2015 to 20% in 2024, reaching 1.5 million 300mm wafers per month in 2024. Non-Chinese organizations will represent a “substantial portion of that growth”, but Chinese-owned organizations are speeding up their capacity investments. SEMI expects they will account for 43% of China’s fab capacity in 2020 and reach 50% by 2022 and 60% by 2024.

According to SEMI, Korea will lead the regional investments (between US $15 billion and US $19 billion), followed by Taiwan (between US $14 billion and US $17 billion) and China (between US $11 billion and US $13 billion).

SEMI emphasized that memory will account for the bulk of the increase in 300mm fab spending. DRAM and 3D NAND contributions to 300 mm fab spending will be uneven from 2020 to 2024, while the investments for logic and microprocessors will have steady improvements from 2021 to 2023.

Power devices will see significant growth in 2021, rising 200% and with double-digit increases in 2022 and 2023, respectively.

To develop this report, SEMI said it has examined 286 fabs/lines from 2013 and 2024, and more than 50 companies and organizations from around the world.

Companies producing logic chips, such as Intel, GlobalFoundries, TSMC, UMC and others, are also expected to increase their own budget at a significant rate, though some will prefer to upgrade existing fabs rather than build new ones.

Stay tuned for more!

Hello, my name is NICK Richardson. I’m an avid PC and tech fan since the good old days of RIVA TNT2, and 3DFX interactive “Voodoo” gaming cards. I love playing mostly First-person shooters, and I’m a die-hard fan of this FPS genre, since the good ‘old Doom and Wolfenstein days.

MUSIC has always been my passion/roots, but I started gaming “casually” when I was young on Nvidia’s GeForce3 series of cards. I’m by no means an avid or a hardcore gamer though, but I just love stuff related to the PC, Games, and technology in general. I’ve been involved with many indie Metal bands worldwide, and have helped them promote their albums in record labels. I’m a very broad-minded down to earth guy. MUSIC is my inner expression, and soul.

Contact: Email